By Kumar Balani

An exchange-traded fund or ETF in short is a type of investment fund and exchange-traded product.

These assets are traded on stock exchanges. ETFs are similar in many ways to mutual funds, except that ETFs are bought and sold from other owners throughout the day on stock exchanges whereas mutual funds are bought and sold from the issuer based on their price at day’s end.

An ETF holds assets such as stocks, bonds, currencies, futures contracts, and or commodities such as gold bars, and generally operates with an arbitrage mechanism designed to keep it trading close to its net asset value, although deviations can occasionally occur.

Net Asset Value or NAV is the value of an entity’s assets minus the value of its liabilities, often in relation to open-end or mutual funds, since shares of such funds registered with the U.S. Securities and Exchange Commission are redeemed at their net asset value.

It is also a key figure with regard to hedge funds and venture capital funds when calculating the value of the underlying investments in these funds by investors. This may also be the same as the book value or the equity value of a business.

Net asset value may represent the value of the total equity, or it may be divided by the number of shares outstanding held by investors, thereby representing the net asset value per share.

Most ETFs are index funds: that is, they hold the same securities in the same proportions as a certain stock market index or bond market index.

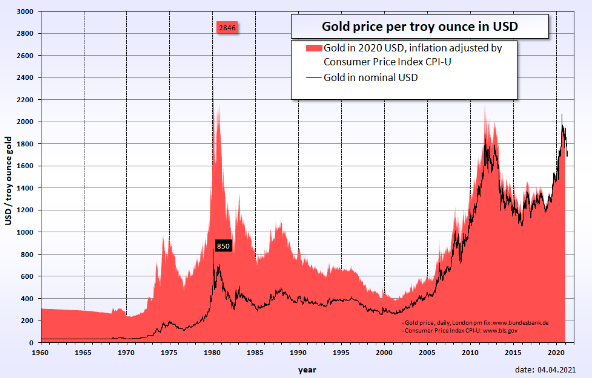

The most popular ETFs in the U.S. replicate the S&P 500 (representing 500 of the largest publicly-traded firms by market price), the total market index, the NASDAQ100 Index, the price of gold, the “growth” stocks in the Russell 1000 Index, or the index of the largest technology companies.

With the exception of non-transparent actively managed ETFs, in most cases, the list of stocks that each ETF owns, as well as their weightings, is posted daily on the website of the issuer.

The largest ETFs have annual fees of 0.03 percent of the amount invested, or even lower, although specialty ETFs can have annual fees well in excess of one percent of the amount invested.

These fees are paid to the ETF issuer out of dividends received from the underlying holdings or from selling assets.

An ETF divides ownership of itself into shares that are held by shareholders. The details of the structure (such as a corporation or trust) will vary by country, and even within one country there may be multiple possible structures. The shareholders indirectly own the assets of the fund, and they will typically get annual reports.

Shareholders are entitled to a share of the profits, such as interest or dividends, and they would be entitled to any residual value if the fund undergoes liquidation. ETFs may be attractive as investments because of their low costs, tax efficiency, and tradability.

As of August 2021, $9 trillion was invested in ETFs globally, including $6.6 trillion or nearly 75 percent invested in the United States. In the U.S. the five of the largest ETF issuers hold nearly 90 percent of them, namely:

- BlackRock iShares with a 35 percent market share

- The Vanguard Group with a 28 percent market share

- State Street Global Advisors with a 14 percent market share

- Invesco with a 5 percent market share, and

- Charles Schwab Corporation with a 4 market share.

Closed-end funds are not considered to be ETFs, even though they are funds and are traded on an exchange. Exchange-traded notes are debt instruments that are not exchange-traded funds.